tax on forex trading in south africa

Ad Perte limité au capital investi. Small business corporations in contrast to.

15 Best South African Brokers 2022 Comparebrokers Co

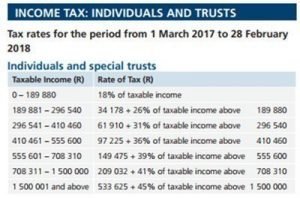

In 2022 a fixed tax of 28 from taxable income applies to any forex trading conducted through a company registered in South Africa.

. Forex is legal in South Africa as long as it does. If you trade CFDs then you are subject to capital gains tax CGT on gains from your trading activities. As a result the profit that you make from trading forex meets the defection of gross income in the Income Tax Act and thus would be taxed as income based on the income tax.

Forex gains and losses would be declared under the foreign income section and then in the businesstrading box. Trading income is profits minus losses and other associated trading expenses. You would be taxed on the profit made if you are trading the forex and not just holding onto it for a few years as an investment.

It can also be listed as foreign income but it will still be taxable even if profits are generated. Mifid Trading Compliance - Serve clients with lightning fast and interactive solutions. You will have to pay income tax on the income you earn from forex trading at your marginal rate if you make money from it.

The tax rate on forex trading undertaken through a South African registered firm is 28 percent of taxable income with no exemptions or deductions. A flat tax of 28 of taxable income applies to any forex trading conducted through a South African registered firm. Residents are taxed based.

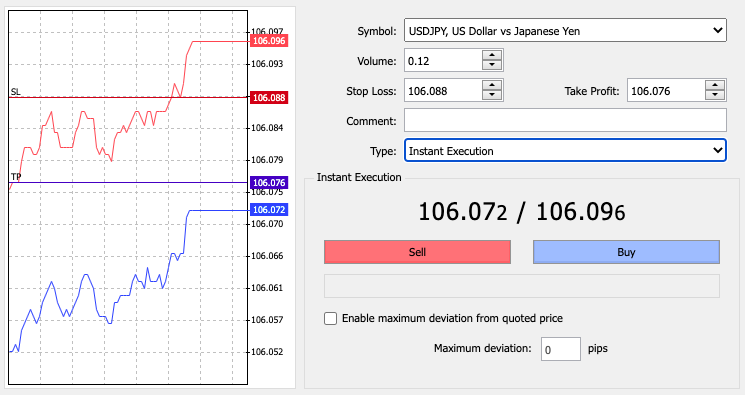

Hotforex is our 1 recommended broker for Forex trading in South Africa. Découvrez Comment Utiliser MT4 - la Meilleure Plateforme de Trading. The ability to make tax deductibles allows traders to maintain maximum capital to continue their forex.

According to Securities Service Act in 2004 binary options industry is classified as a derivative instrument. Using FSCA regulated brokers is not. Ad Add your own proprietary data and make it all accessible via your own infrastructure.

Retirees may also want to consider state estate taxes before choosing to relocate for favorable pension tax rates. Before this is paid all expenses incurred should be deducted to determine the total taxable amount and as every South African resident is required to pay tax on international. Ad Add your own proprietary data and make it all accessible via your own infrastructure.

Profits earned by a business are. CGT is 10 for basic rate taxpayers when total income is 12571 to 50270. Yes Forex trading is taxable in South Africa because it is classified as a legal form of income.

As long as you abide by international monetary exchange controls and declare income earned from forex. Residents of South Africa are taxed on worldwide income so your annual tax return must contain details of the successful withdrawals that you have made via Forex trading. 12 pips spread on average for EURUSD with Premium Account no deposits withdrawals fees.

81 des clients particuliers sont perdants. Ad Perte limité au capital investi. If you are a South African taxpayer that wants to trade in forex then you will pay tax on your profits at the rate that applies based on your total income.

All expenses incurred from your forex trading must be deducted from the gross income of the trading to calculate the taxable profit from your forex trading. However when it comes to small. While the Forex market in this region is not a major trading hub like the four big trading sessions it is the major hub in Africa.

In other words 60 of gains or losses are. Put another way you can deduct all expenses you. Profits from a trading account held in your name are subject to income tax.

7 Winning Strategies for Trading Forex Pdf. Forex tax calculator south africa is forex trading legal in south africa. Découvrez Comment Utiliser MT4 - la Meilleure Plateforme de Trading.

In 2007 The Bond Exchange of South. Marc Sevitz of TaxTim responds. Trading Forex in South Africa is legal as long as you declare your income tax and you abide by financial laws that prevent money laundering.

Even when you generated profits in your offshore forextrading accounts you are obliged to pay income tax on the profits. Mifid Trading Compliance - Serve clients with lightning fast and interactive solutions. Any profits you make with Forex trading are taxable just like your regular income which means you have.

Forex Trading for the purposes of making a. No forex trading is not illegal in South Africa. In contrast to corporations small business corporations are.

81 des clients particuliers sont perdants. For tax purposes forex options and futures contracts are considered IRC Section 1256 contracts which are subject to a 6040 tax consideration. The current limit on outgoing cash flow from South Africa is R10 million per person.

Is Forex trading taxable in South Africa. The taxes of Forex trading gains in South Africa are straightforward. The rate of tax would be.

Forex Trading In South Africa 2022 Complete Guide

Forex Trading Academy Best Educational Provider Axiory

Realistic Forex Income Goals For Trading

How To Identify Forex Scams In South Africa Fake Brokers List Forex Trading And Investing Blog Daily Forex

How To Trade Forex Forex Trading Examples Ig South Africa Ig South Africa

Tax Implications For South African Forex Traders Who Reside In South Africa Tradeforexsa

South Africa 2015 Budget Could Tax Reforms Stifle Economic Growth

Barclays Citi Helped South Africa With Forex Trading Probe Sources Fox Business

Taxes On Trading Income In The Us Tax Rate Info For Forex Or Day Trading

How To Avoid Tax Trading Forex In South Africa

Is Forex Trading Taxable In South Africa 2022

10 Best Forex Trading Apps For October 2022

Do Forex Traders Pay Tax In South Africa

What Is Isr Tax An Vicitm Was Cheated 1 000r By Expert 24 Trade Neuigkeiten Wikifx

Successful Forex Traders In South Africa And Their Stories That Inspire Others

Amazon Com Forex Trading All In One The Best Guide For Forex Trading Including Trading Strategies Candlesticks Money Management Profit Management And Practical Examples To Become An Expert Forex Trader 9798413558300 Richardson Francis